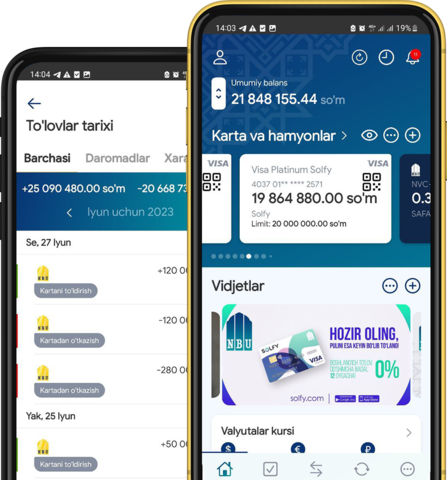

Jismoniy shaxslar uchun

Kichik bizneslar uchun

Korporativ mijozlar uchun

Aksiyadorlar va investorlarga

- Muhim faktlar

- Bank aksiyadorlari

- Aksiyadorlar umumiy yig'ilishi materiallari

- Qimmatli qog'ozlar haqida ma'lumot

- “O‘zmilliybank AJ” AJ affillangan shaxslari

- Bank biznеs rеjasi

- “O’zmilliybank” AJ besh va undan ortiq foiz aksiyalarga (ulushlarga, paylarga) egalik qilayotgan yuridik shaxslar ro‘yhati

- Aksiyador va investorlarga e'lonlar

- Evrobond emissiya 2020

- Tashqi qarz hisobidan moliyalashtirilgan loyihalar

- Aksiyalarni aksiyadordan sotib olishning imtiyozli huquqi

- Dividеndlarni to‘lash haqida ma’lumot

- Bank Ustavi

- Korporativ boshqaruv

- Boshqaruv organlari

- Ma’lumotlar ochiqligi

- Ichki normativ hujjatlar (ishlab chiqilgan yo‘riqnomalar)

- Bank stratеgiyasi